We’ve recently made updates to our displayed trading on IEX. Notable changes include rolling out post-only functionality, updating our signal, and enhancing our rebate program for displayed adding. These changes are designed to improve the IEX displayed trading experience, which offers superior all-in markout performance and the ability for pre-trade price improvement with D-Limit. We’re highlighting a few notable results in this blog.

Displayed market share

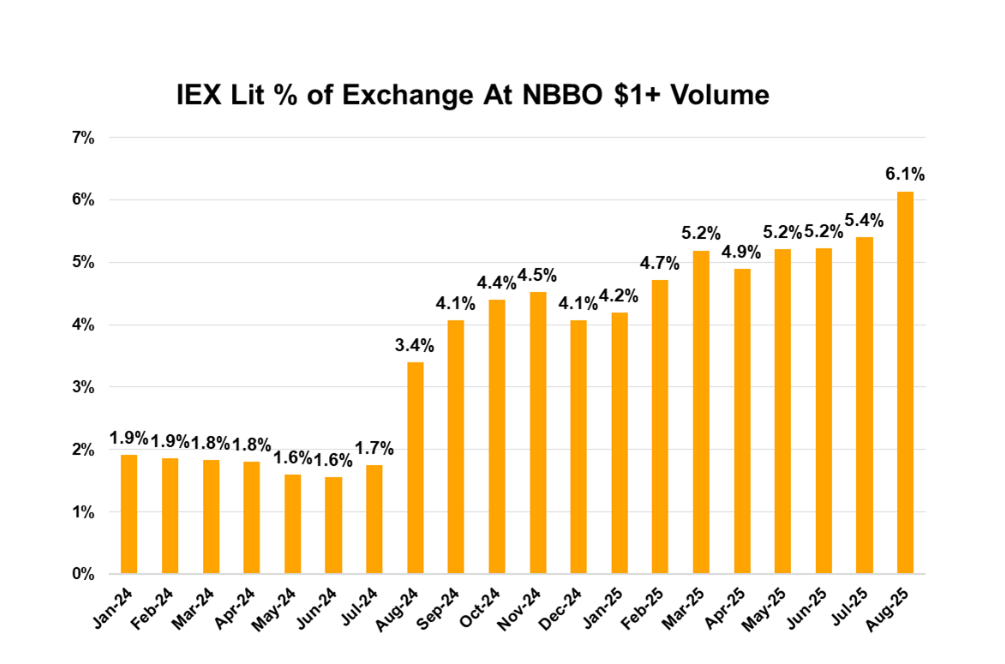

IEX’s displayed market share has grown significantly since 2024. Looking at IEX as a percentage of on-exchange at-NBBO volume more than $1*, IEX has reached new highs in August 2025, more than three times prior levels.

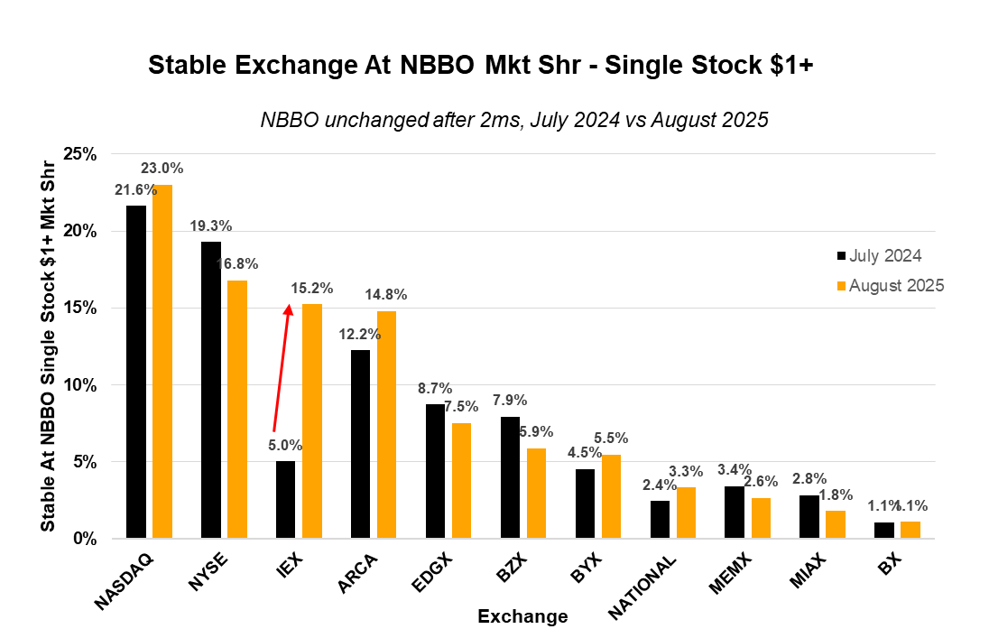

If we consider just “stable” lit trades—trades at the NBBO where the NBBO does not change within two milliseconds after the trade—we see that IEX now accounts for 15.2 percent of near-side exchange volume.

Quote growth

IEX has seen substantial growth in our amount of displayed quoting as well. While most other exchanges charge clients 30 mils per share to remove displayed liquidity, removers of IEX displayed liquidity can pay 22 mils per share.2 Our quote growth in the past year means that IEX’s take rate is now available more often.

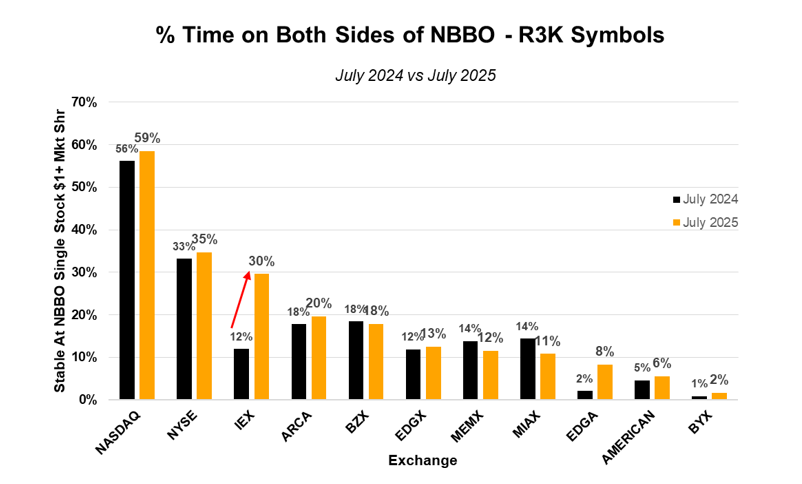

Looking at the Russell 3000, a broad market index of U.S. single stocks, we see that IEX’s percentage of time on both sides of the NBBO has grown to 30 percent. We can see that IEX now has more time on both sides of the NBBO in R3K names than every exchange except NYSE and Nasdaq.

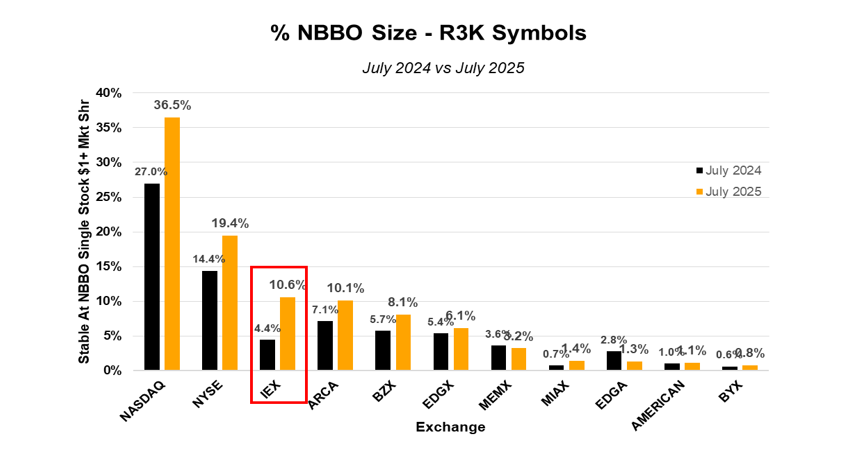

We know additionally, liquidity seekers value quote size. IEX’s percentage of NBBO size in Russell 3000 names has more than doubled over the last year and is now larger than any exchange except NYSE and Nasdaq.

IEX’s quote growth is also important to other liquidity providers looking to “blend in” by posting displayed liquidity only at sufficiently large venues.

Markouts

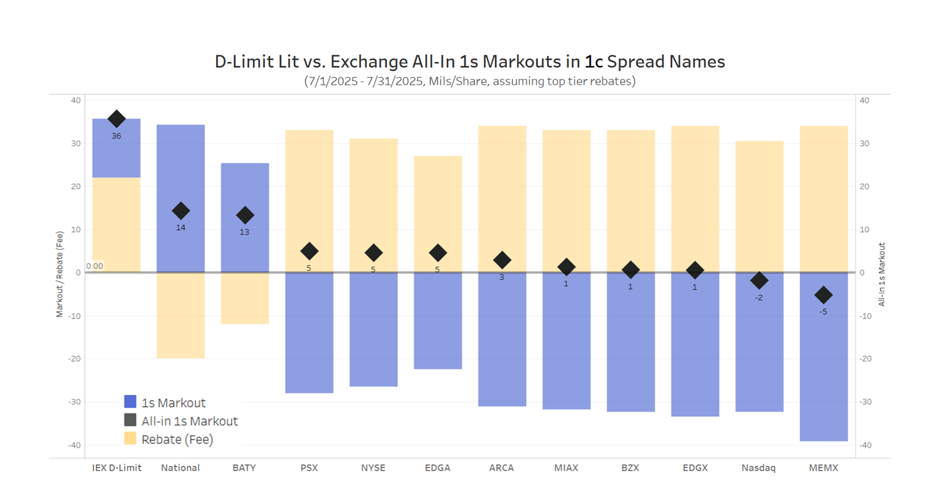

One common way to measure the performance of displayed orders is via a markout, or the price change following a trade over a specified time frame. IEX has been able to achieve substantial displayed growth, while maintaining superior markouts. IEX’s Lit D-Limit’s all-in markouts, a metric that accounts for both markouts and net trading fees or rebates, have widened their lead over the competition. These markouts are now more than double all other exchanges’ at the one-second horizon in one-cent spread names in mils per share. They are also nearly seven times greater than any other maker-taker exchange.

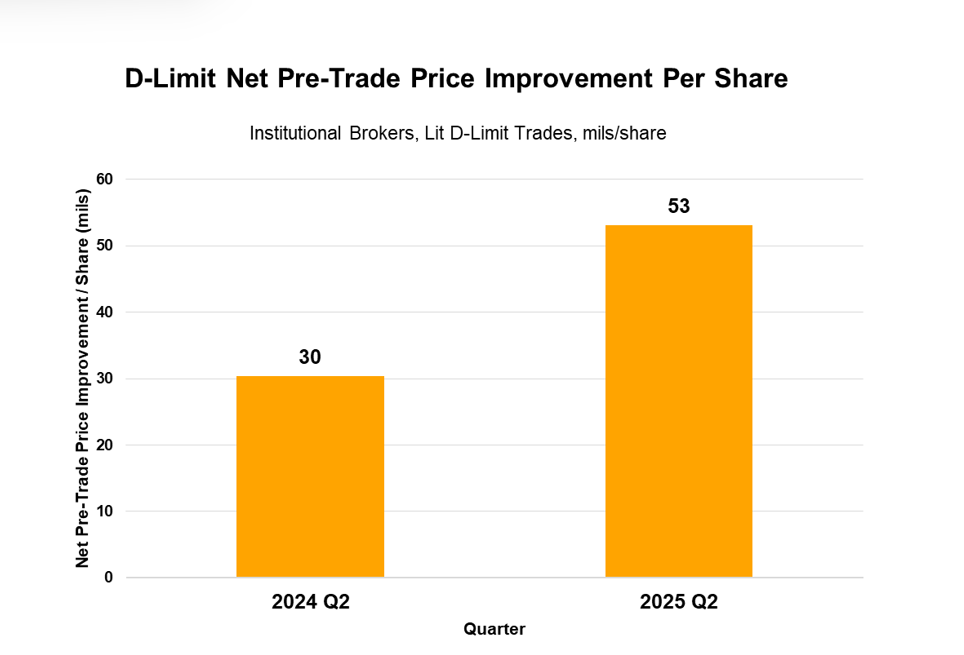

Pre-trade price improvement

IEX Lit D-Limit is the only exchange displayed order type that can deliver pre-trade price improvement, where an order is filled at better than its limit price after coming to rest. We believe this unique benefit of D-Limit can be particularly impactful to passive institutional algo orders that care about performance benchmarks like Slippage vs. Arrival Price and Slippage vs. Interval VWAP. Institutional brokers using Lit D-Limit are receiving a net average of over 50 mils per share in pre-trade price improvement, which comes out to over 1 basis point across all D-Limit volume, up more than 75 percent versus Q2 2024.3

Since Q2 2024, IEX has continued to improve our value proposition for displayed trading. We’ve experienced substantial growth and offer unique functionality.

If you want to learn more about D-Limit or discuss how to optimize your displayed trading experience on IEX, contact your sales representative or drop us a line at sales@iextrading.com .

Originally published September 2024; updated November 2025.

1. Data includes only securities priced at or above $1.00 per share.

2. See the following link for a full listing of the IEX transaction fee schedule. Rates quoted represent rates for securities priced greater than or equal to $1.00 per share.

3. IEX Exchange classifications are on a best-efforts basis by member firms’ trading sessions.